The most balanced opinion on cryptocurrency investments

From payment method to investment asset

In recent years, cryptocurrencies have attracted the attention of the financial community, both investors and onlookers, provoking highly polarised opinions. From crypto maximalists who believe they will revolutionise the global financial system with Bitcoin or another cryptocurrency as the sole method of payment to those who consider cryptocurrencies to be frauds, gambling, scam or pyramid scheme, public opinion is quite divided.

Foremost, as context, the creator of Bitcoin, Satoshi Nakamoto, presented Bitcoin as a decentralised electronic currency, designed to allow direct transactions between parties without the need for financial intermediaries such as banks.

As Bitcoin and other cryptocurrencies have grown in popularity, they have slowly become, in addition to a payment method accepted by both individuals and businesses, an investment and store of value tool for many people around the world. The main factors driving this have been in order of importance:

- The possibility of unimaginable returns on other investment asset classes amid increased volatility;

- Ease of trading thanks to the increasingly simple interfaces of other trading platforms;

- The affordability of investments by being able to invest small amounts, starting from 10-20 euros or even less;

As enthusiasm and adoption grows, so does the tide of distrust or even hatred; critics say: "Crypto is SCAM, fraud or even gambling. Don't invest because you will lose your money, cryptocurrencies are not backed by anything."

Let's deal with these accusations individually:

- "Crypto is SCAM". The main problem here is generalisation. At this moment ( May 26th, 2023), according to CoinMarketCap.com, there are 24,817 cryptocurrency projects. Yes, of these there are weak projects or even possible scams, but this depends only on the founders of the projects, which are different in most of these projects, and not on the technology. For example, Bitcoin is already 15 years old, with a huge market capitalization, thus a very good track record. So is Ethereum, the 2nd largest cryptocurrency by market capitalisation, with a market age of almost 9 years; and the examples could go on.

- "Don't invest because you will lose money". According to this advice, we should not invest in the classic stock market either, where, according to public studies, an overwhelming majority of investors lose 85-90% of their money; or in start-ups where only 18-20% of companies survive. Not to mention insurers or even big banks that have recently gone bankrupt despite strong regulation in these areas.

- "Cryptocurrencies are not backed by anything". We'll keep it brief here: Bitcoin is backed "proof of work" – miners who validate transactions with expensive and energy-intensive equipment that costs from production, installation to maintenance. Most importantly, behind the projects is BLOCKCHAIN TECHNOLOGY, this Internet 2.0 that is starting to be used in more and more areas.

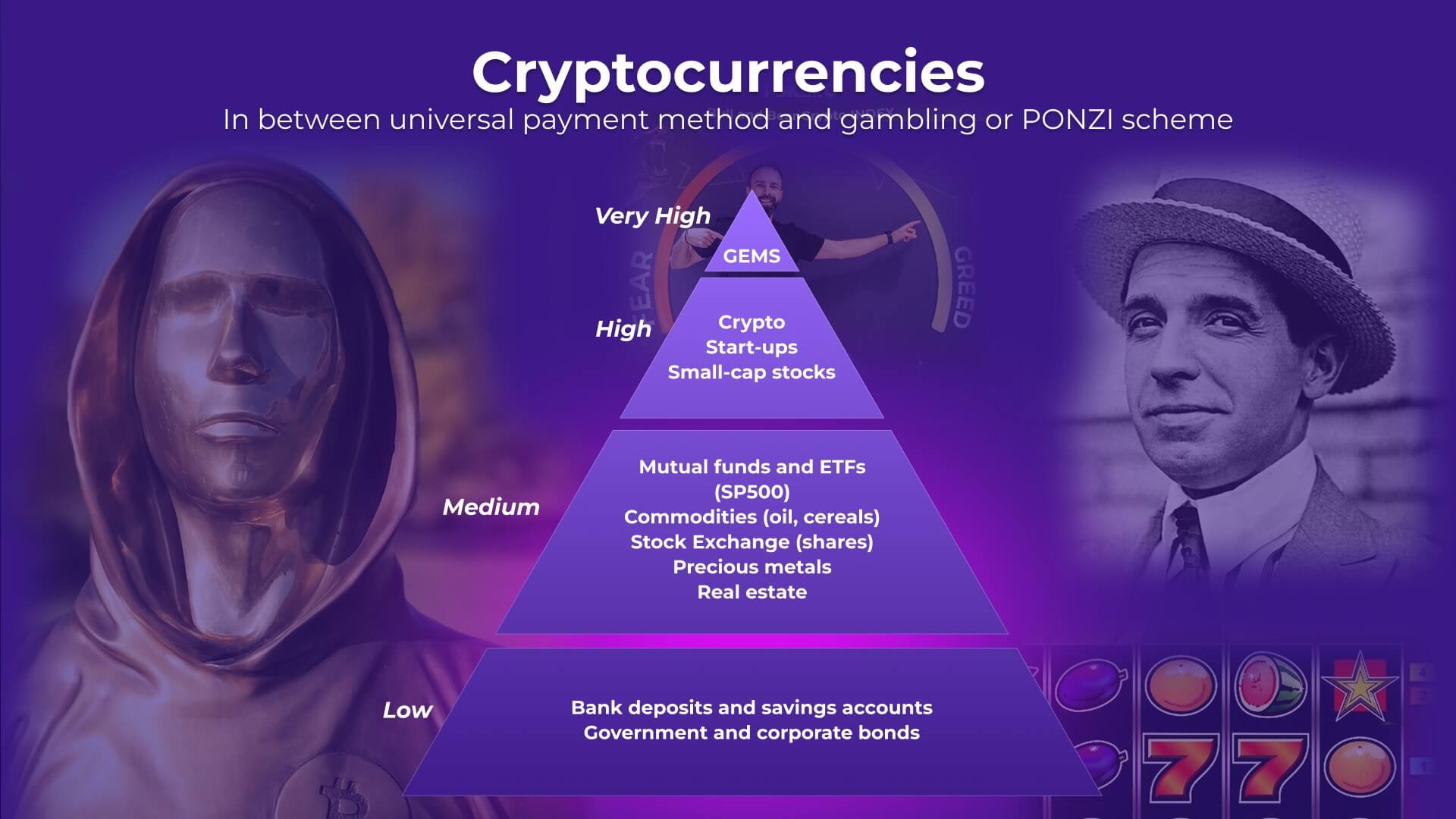

I believe that after all these arguments it is time to position cryptocurrency investments where they belong – at the top of the investment pyramid, among the top investments according to risk level. High-risk investment assets, but there's no doubt that they are asset.Not SCAMS, not gambling.

Pyramid explained? If at the bottom we have investments perceived as stable or much more stable – deposits, government bonds, real estate, towards the middle are precious metals, stocks, bonds and ETFs, then towards the top is the area of startup and crypto investments.

In turn, cryptocurrencies can be divided into risk levels – based on the world's number 1 and 2 – Bitcoin and Ethereum, then top 100 cryptocurrencies and at the top the so-called GEMS – undervalued projects with massive potential. Beyond the line, in the gambling area, we can agree to ditch the so-called "shitcoins" – useless cryptocurrencies, created without a specific purpose and whose future is highly uncertain. DogeCoin, Elon Musk's favourite coin meme may be the exception that reinforces the rule. And more recently: $PEPE.

Any investor with minimal investment knowledge knows that most of the investment allocation should go to the safer asset classes at the bottom of the pyramid, allocated according to the investor's risk profile and investment plan.

Another basic principle is DIVERSIFICATION: therefore, correlated with the undeniably very good yields achieved over the years, a small percentage should also go to the crypto area. So, the question need not be "Whether to invest in crypto?" but rather "What percentage should I allocate to crypto investments?" and "Between which cryptocurrencies should I divide the percentage allocated to crypto?".

Nor should it be ignored that large investment funds and international companies have invested in crypto. These include Grayscale Investments LLC, Pantera Capital, Andreessen Horowitz, MicroStrategy and Tesla. JPMorgan Chase, Goldman Sachs and Morgan Stanley have also started offering cryptocurrency trading services to their institutional clients.

Beyond words, the numbers speak for themselves, according to numerous studies (see Yahoo Finance or Cointelegraph) Bitcoin and Ethereum are by far the best performing assets of the last 10 years. (We verified the information with ChatGPT in case you still don't believe us):

Marius Morra: "What has been the best performing investment asset of the last 10 years?"

ChatGPT: "It is difficult to determine exactly what has been the best-performing investment asset over the past 10 years, as performance can vary depending on the different time periods considered and other factors. However, a few investment assets have performed significantly over the past decade. Here are a few examples:

-

Bitcoin: Bitcoin has been one of the best performing investment assets over the past 10 years. This cryptocurrency has seen a significant increase in value since its creation in 2009. Over the period 2011-2021, the price of bitcoin has seen significant increases and reached new all-time highs."

And yes, not everyone has the opportunity to invest (although many could, but there is still a need for education on the subject), but almost everyone can do one or a few first transactions to see what the process is all about. Investments can be as low as €10-20, with minimal fees – accounts on trading platforms are free and exchange fees around 0.5-1%. The payoff? Apart from the financial potential, there is the unfortunately little discussed potential of knowledge gained and access to a new world – the world of investment and Web3 – the new internet where you read, contribute and own. In Web3, the access keys are one or more wallets and cryptocurrencies. Cryptocurrencies are the key to the future.

From our experience, the difference between someone who has never made a cryptocurrency transaction and someone who has made at least one is considerable. The person who has made a trade, no matter how small, has learned the process, can follow a crypto discussion with knowledge, and most importantly, is much more prepared for when an opportunity arises. Because historically, major opportunities come along every 2-3 years. Also, many of those who invest in crypto educate themselves as they use crypto platforms, learn the process, learn about investing, and start investing in other types of investment assets. We can say that access to crypto helps access to investing in general.

But crypto is not just about speculative investments. With the significant growth in adoption and projects in recent years, the number of jobs available in this field has also increased. Due to its technological nature, these jobs are generally related to IT, software development and cyber security, but there are also opportunities in marketing, management, legal, accounting and other related areas. Crypto specialists are not only highly in demand, but also highly paid. Also, in state institutions – the National Bank, the National Office for Prevention and Control of Money Laundering, the Police and others, there are departments related to crypto, where people who have minimal information related to this industry are promoted.

And because we've reached the area of regulation, a big fear of critics is that cryptocurrencies can be used in drug trafficking, terrorist financing and other crimes. Here, the simplest argument we can offer is that exchanges are subject to existing anti-money laundering laws, so KYC (Know Your Customer) and AML (Anti Money Laundering) technologies are implemented, source and proof of funds are required like banking transactions.

Also, these activities unfortunately existed until 2008 when Bitcoin emerged, so we cannot see a direct correlation of causality. It is well known that the most anonymous means of financing illicit activities is fiat currency in cash form.

In conclusion, after this plea, I have the following request: if any great Romanian or foreign financial analyst is still shouting out loud and clear against crypto, comment with a link of this article.

I admire and respect some of them until they start discussing crypto, where logic is unfortunately fading away. And sure, I can accept that I'm clueless, but I find it hard to believe that Elon Musk or Michael Saylor don't know what they're doing.

In terms of market cap, cryptocurrencies today are worth around $1.1 trillion in total. By comparison, McDonalds has 206 billion and gold has 12 trillion, so we can conclude that the cryptocurrency market is big enough to be reckoned with, but small enough to have very high growth potential.

As we say here, "We're still early"!

The question I'll leave you with today is: what do you want to be? Actor or spectator? Gambler or investor? I have good news – the choice is 100% yours, so choose SMART!